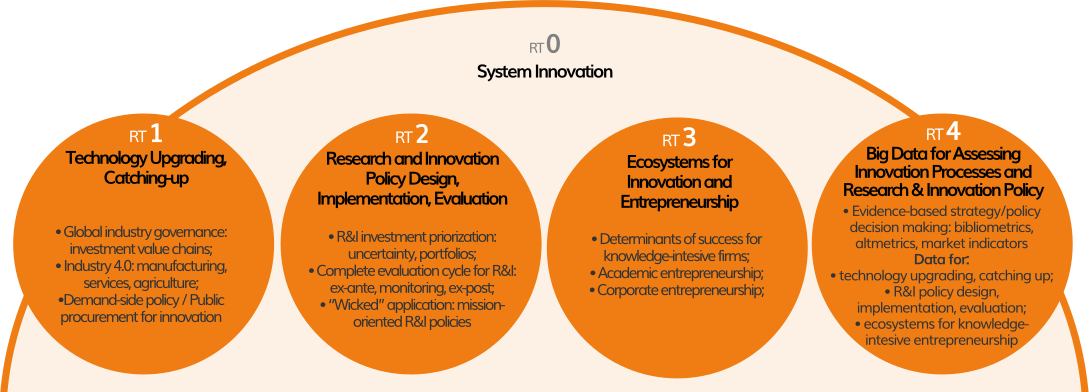

RT1. Technology Upgrading, Catching-Up

A lengthy body of research has pointed out the existence of polarization between the club of rich and the group of poor countries, indicated by the growing divergence in innovation intensity (Castellaci, 2011). Catching up with advanced countries entails multiple facets of system innovation functioning well. One promising approach to explaining the dynamics has been recently put forward as Technology Upgrading (Radosevic and Yoruk, 2016, 2018). While not a new concept – akin to “structural change” in economics – its current articulation involves a complex array of vectors of interest closely connected to the diversification in the knowledge portfolio of nations (Lee, 2013) and to the omnipresent interaction of global and local actors (firms, universities, governments) (Ernst and Kim, 2002). Indicators of technology upgrading should consider several dimensions including: i) the intensity of production, research and technology generation activities; ii) the breadth of technology upgrading (technological diversity, types of supporting infrastructure and organizational capabilities of firms); and iii) economy-wide knowledge inflows and outflows through a variety of forms such as trade, foreign investment and disembodied knowledge flows. The economic development literature has emphasized the importance of learning, capabilities, and “windows of opportunity” as key factors of catch-up (Dantas and Bell, 2011; Figueiredo, 2002, 2003; Lee, 2013, forthcoming; Lee and Malerba, 2017; Mathews, 2002). Narrowing the technology gap with advanced countries functions differently than pushing the knowledge frontiers back (Fischer, 2018b).

In this multi-faceted process, the international fragmentation of production and the positioning of firms and countries across the activities of global value chains (GVCs) and the networks they impose is key. Directly related to global flows of foreign direct investment (FDI) (UNCTAD, 2018) borderless production systems are typically coordinated by multinational corporations (MNCs), with cross-border trade of production inputs and outputs taking place within their networks of affiliates, contractual partners and arm’s-length suppliers (Baldwin, 2011; Gereffi et al., 2005; OECD, 2013).

This new global productive pattern has facilitated the emergence of developing country economies and their insertion in international trade and foreign direct investment flows through specialization in specific stages of value chain (vertical specialization) instead of building the whole value chain at home as in the past (Baldwin, 2011; Pietrobelli and Rabellotti, 2011; Porter, 1986). The capture of opportunities brought about by GVC integration depends on the nature and stages of the chain in which the country is inserted, the governance and chain control, the institutional and business environments, the imported content of productive activities, domestic capabilities, and policies (Morrison et al., 2008; Pietrobelli and Rabellotti, 2007, 2011). Results are not guaranteed: some economies have benefited from the movement of offshoring and outsourcing much more than others (Gereffi and Luo, 2015; Taglioni and Winkler, 2016).

A critical underlying factor both promoting and facilitating the widespread adoption of such practices – of immense importance to emerging economies like Brazil aspiring to close the gap and avoid “middle-income traps” (Agenor, 2016; Im and Rosenblatt, 2013) – is the ongoing (and intensifying) technological wave described by the terms Industry 4.0 (I4.0) and the Internet of Things (IoT). A variety of definitions have been proposed to describe it (Glas and Kleeman, 2016; Schuh et al., 2017). In general, I4.0 refers to the movement configuring the so-called 4th Industrial Revolution involving the reorganization of processes for greater agility and coordination of production through the use of integrated digital technologies for efficiency gains. I4.0 integrates a set of key technologies considered fundamental for changes in the current production mode: big data and analytics; robotics, simulation, integration of horizontal and vertical systems, IoT, cybersecurity, cloud, additive manufacturing and augmented reality (Gerbert et al., 2015).

Several countries have adopted national I4.0 strategies including Germany (Industry 4.0), South Korea (Industrial Innovation 3.0), Japan (Robotics Strategy, Connected Industries), France (Industry of the Future), China (Made in China 2025), USA (Partnership for Advanced Manufacturing), to name a few (ABDI, 2017; IEDI, 2018). The strategies are diverse reflecting the disruptive character of I4.0 seemingly to result from the articulation and convergence of these technologies (IEDI, 2018). As for Brazil, in July 2017 a Working Group for Industry 4.0 (GTI 4.0) was created aiming at proposing a National Strategy for Industry 4.0 (or Advanced Manufacturing, used as synonym), under the coordination of the Ministry of Development, Industry and Foreign Trade (MDIC). Simultaneously, Agriculture 4.0 (or Digital Agriculture) galops towards a major transformation for animal and plant production, representing a challenge and concrete opportunity for the catching-up process of the country.

The importance of the preceding factors notwithstanding, one should not disregard the potential of supply-side policies that need to play for technology upgrading and economic catching- up. Demand-side policy includes measures to stimulate innovation by increasing demand and improving the demand articulation for innovative product ideas (Edler and Georghiou, 2007; Edler and Yeow, 2016; Uyarra et. al., 2017). A very important demand-side policy tool is public procurement for Innovation (PPI) (Edquist et al., 2015). Its importance emanates from the fact that public procurement represents 12% of GDP and 29% of total government expenditure of OECD member countries (OECD, 2017) and is the largest single market in developed and developing economies (World Bank, 2017). In Brazil, purchases by government and public organizations, including state-owned enterprises, accounted for about 14% of GDP in 2012 (Ribeiro et al., 2017).

This very important instrument can potentially be used strategically to incentivize innovation (Edler and Georghiou, 2007; Edler and Yeow, 2016; Edquist et al., 2000). This has led to the reemergence of a large volume of literature in the past few years promoting the idea of PPI as a tool for catching up and technology upgrading strategies in developed and emerging economies. The topic is not new for Brazil which can point at several significant accomplishments that were largely the result of PPI such as the Brazilian Aeronautics Command (COMAER) to Embraer helping to turn the company into one of the world’s leading aircraft manufacturers (Frischtak, 1994; Vértesy, 2012, 2017). Reforms in the Brazilian Innovation Law (Law #13.243 of 2016 and its regulation in 2018) provide new standards for PPI implementation. Still, PPI faces significant challenges due to legal and institutional constraints and problematic interactions between public procurers and suppliers (Edler et al., 2005; Chicot, 2017; Uyarra et al., 2017).