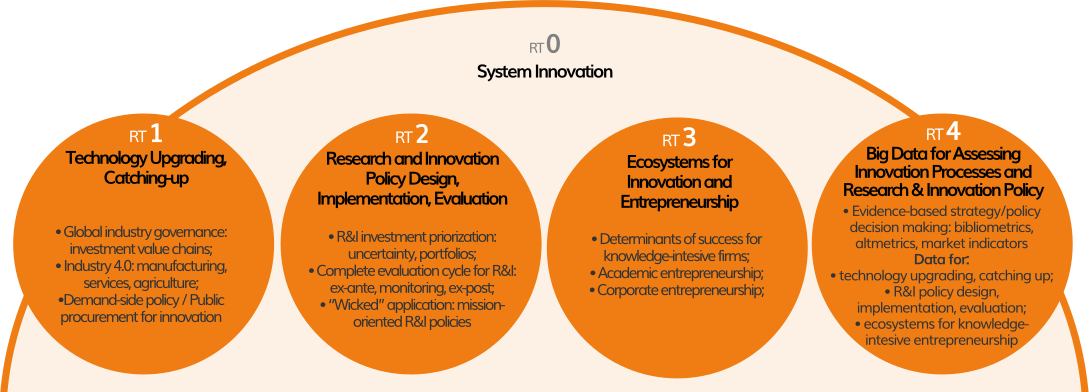

RT3. Ecosystems for Innovation and Entrepreneurship

Knowledge-intensive entrepreneurship (KIE) is unevenly distributed in geographical space, largely attributed to heterogeneous endowments in terms of knowledge, institutions, resources and demand (Isaksen and Trippl, 2017). Different regions are embedded in different contexts and this translates into distinct innovation dynamics, leading to a spiky geography of economic activities (Crescenzi and Rodríguez-Pose, 2012). Entrepreneurial ecosystems have drawn attention in the fields of entrepreneurship studies, economic geography and urban economics and gained popularity with policy decision makers (Audretsch and Belitski, 2017; Stam and Spigel, 2016).

The fact that KIE is deeply embedded in local contexts (Cooke et al., 1997) poses fundamental challenges for analysts and policymakers, as one-size-fits-all initiatives are deemed inappropriate (Nicotra et al., 2018). The rates of KIE success are affected by the performance of any of the systemic components involved in its dynamics (Ács et al., 2014). Freytag and Thurik (2007) stress the relevance of an “entrepreneurial environment” comprising issues related to economic regulations, administrative complexity, intellectual property rights, education, etc. operating differently in distinct locations with varying socioeconomic backgrounds (Ács et al., 2017). The lack of empirical understanding on the determinants of success of KIE reduces the ability of policymakers to design well-guided initiatives that make efficient use of public resources (Fischer et al., 2018a). Specifically, a gap of knowledge persists for developing economies, which end up relying on conclusions drawn from the context of developed countries.

By general acclaim, universities are perceived as most important actors in entrepreneurial ecosystems targeting innovation. They function as agents of regional development through direct and indirect contributions to productive structures (Mowery and Sampat, 2005). It is within this context that the “entrepreneurial university” concept has gained popularity. It emphasizes the third mission – beyond education and basic research – to include joint R&I projects with industry and various forms of technology transfer such as spin-offs, patents, licenses, and consulting activities (Etzkowitz, 2004; Van Looy et al., 2011). The entrepreneurial university is prone to cooperating with industrial partners with expected benefits for both sides: firms can enhance their innovative potential and reduce R&D costs, while accessing new knowledge in scientific and technological fields (Agrawal, 2001); universities can have access to external funding and boost research productivity (Arza, 2010). Moreover, such activities generate learning and networking externalities within the academic context, planting the seed for increased entrepreneurial capabilities (Alvedalen and Boschma, 2017). University spin-offs are an important vehicle for research commercialization, allowing basic research to reach out to industry (Perkmann and Walsh, 2007).

Still, university–industry linkages per se do not automatically lead the generation of spin- offs or other advantages. Emerging economies are starting to realize the need for autonomous research that will take into consideration their specificities, local work engagements relating to the joint production of knowledge, innovation, and research and local entrepreneurial behavior (Fischer et al., 2018a, 2018b; Lai and Vonortas, forthcoming).

Last, but certainly not least, the activities of large incumbent firms are key for the local environments they operate in. This became obvious in our earlier (TR1) reference to the importance of (global) value chains such companies set up. Here we focus on their activities to develop new business in an effort to renew themselves through new combinations of resources (Baumol, 1986). Described by the term corporate entrepreneurship, such activity is comprised by corporate venturing and strategic entrepreneurship (Yunis et al., 2018). Corporate venturing relates to new business creation and includes both internal (to the corporation) ventures and external ventures. While different models of engagement prevail, the provision of corporate venture capital and sustenance of corporate incubators are the most common (Weiblen and Chesbrough, 2015). Both deal with promising ideas and new technologies that are born inside the corporate environment but do not match with corporation’s business model or current core business.

Corporate venturing activities have started to appear in Brazil in the recent years. Since 2014, the Brazilian Trade and Investment Promotion Agency (APEX) has worked to stimulate corporate venture capital investments by large international corporations and to foster entrepreneurial activities in Brazilian companies. This is fertile ground for research.